How Deposit Bonds Can Save You Money When Securing Off The Plan Purchases

How Deposit Bonds Can Save You Money When Securing Off The Plan Purchases

Buying off-the-plan? You could be missing out on the one thing that’s good for your bank balance and your stress levels.

Buying off-the-plan is a popular move for those wanting to purchase a property in Australia, especially first timers. But what many purchasers don’t realise is that using a deposit bond to secure your off-the-plan purchase, rather than borrowing money or using your hard-earned cash from your offset account, has potentially big money-saving benefits. Here’s how:

The real cost of securing your off the plan purchase:

One of the big advantages of buying off-the-plan is that you put down a deposit to secure “today’s price”. It doesn’t matter how much the market value has soared by settlement time, you won’t need to pay any more. (You also have more time to save and can shop around for the right mortgage.)

Typically, the developer will ask for a 10% deposit to secure your off-the-plan property. This is usually held in a legislated trust account and invested until settlement. Then, you pay the balance on completion of the property. Depending on where you buy, this could be anywhere up to five years.

This is where a deposit bond is a savvy move, with the potential to save you dollars.

Take a look at this graph:

Let’s assume that you purchase a $50,000 deposit bond for 1 year – your cost would be $1,475. By comparison, the cost of borrowing funds to pay your $50,000 cash deposit would be around $2,250. So by simply using a deposit bond you can save approximately $775 in interest.*

Now, look at the savings on a 5-year bond: the deposit bond premium would cost $8500, but borrowing the funds would see you paying more than $11,250 in interest! That’s a massive saving of $2,750, which could pay for your legal fees or perhaps that new TV you’ve been eyeing.

Even if you are inclined to pay a cash deposit, unless you’re one of the lucky few, chances are this cash is sitting in an offset account, saving you interest on your home or investment loan. If you were to pull those funds out of the offset to pay this deposit, you’re back incurring the higher rate of interest on your loan balance now owing.

On the other hand, if you leave your savings in a high interest account and use a deposit bond in their place, you will save money.

To summarise, here are 4 reasons to choose a deposit bond for your off-the-plan purchase:

#1. Save your cash deposit

Off-the-plan purchases are renowned for their long settlement periods, sometimes up to five years. And all this time, your cash deposit is tied up without any benefit to your back pocket. Sometimes buyers are entitled to share in the interest earned, but this is rare. Think about it: can your money be put to better use earning interest or reducing other loans in that time? What’s the advantage of putting your $60,000 cash in a trust account for five years without benefiting from the interest? It’s just not practical.

By using a deposit bond in place of a cash deposit, you can make the most of your savings and relieve financial pressure elsewhere.

#2. Cut your costs

Buying a property can be an expensive exercise, so every dollar saved counts! The cost of a deposit bond for an off-the-plan purchase is often cheaper than the interest you would pay (or otherwise forgo) on a cash deposit.

#3. Easy as 1, 2, 3

Want to remove some of the hassle and stress from your moving process? Deposit Assure’s Concierge service makes the whole process as easy as 1, 2, 3:

1. A quick 10-minute chat to see if a deposit bond is right for you and also to obtain the necessary information we need for your application.

2. Sign the application form and provide your supporting documents, like your photo ID, contract of sale, last two payslips, etc. Your concierge officer will give you a detailed list of what is required.

3. Our team will apply for you!

Learn more about our concierge service.

#4 High security

Deposit bonds are a safe way to secure your property – so long as you choose the right provider. Backed by QBE, a deposit bond from Deposit Assure is one of the safest deposit bonds available. QBE is Australia’s oldest and most trusted insurer with an ‘A+ Stable’ credit rating. So your developer will be more than happy to accept it in lieu of a cash deposit.

Want to know how a deposit bond could help you? Talk to Deposit Assure.

*Assumption based on a $50,000 deposit or deposit bond over a term of 1 to 5 years. Cost of paying a cash deposit based on an assumed interest rate of 4.5%pa.

Our Blog

As a property-related service provider—whether you’re a mortgage broker, conveyancer, real estate agent or solicitor—it’s important to continuously improve the services you provide. Having a toolkit that solves your clients’ major pain points ensures that you’re able to keep offering excellent service, boost customer loyalty, repeat business and referrals. The fierce property market has only… Read more »

Guest Post: by Jared Zak from Dott & Crossitt Deposit bonds are being used increasingly in New South Wales and Queensland conveyancing transactions as an alternative to cash deposits. A deposit bond is essentially a promise given by a highly-rated financial institution to pay a vendor a sum equal to ten percent (or occasionally five percent)… Read more »

As we’ve seen recently, when developers and builders go into liquidation, the danger for your customers is that their cash deposit could potentially be tied up for years as the liquidation plays out. Even worse, their cash deposit could disappear – check out this recent news article here So in the current market when you are acting… Read more »

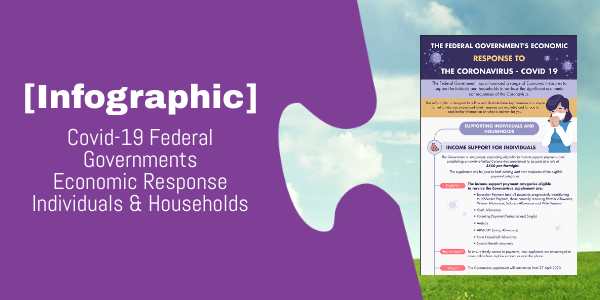

This infographic is designed to collate and illustrate the key measures the Federal Government has taken in response to The Coronavirus – COVID 19.

Ever wondered where deposit bonds came from? Deposit bonds, also known as deposit guarantees, have been helping Australians buy houses for almost two decades. So how did it all begin?

Lodge & Manage Deposit Bonds for your clients

Lodge & Manage Deposit Bonds for your clients