Deposit Bonds: a better alternative than cash deposits?

Guest Post: by Jared Zak from Dott & Crossitt

Deposit bonds are being used increasingly in New South Wales and Queensland conveyancing transactions as an alternative to cash deposits.

A deposit bond is essentially a promise given by a highly-rated financial institution to pay a vendor a sum equal to ten percent (or occasionally five percent) of the purchase price in the event that the purchaser defaults at settlement. They are increasingly being offered as a substitute for a 10% cash deposit.

So for example, Terry wants to buy a property in Kellyville New South Wales for $1m with a 60 day settlement period. He doesn’t have enough money to pay the 10% deposit on exchange of contracts but he will have more than enough to pay that and the remainder of the purchase price at settlement when he refinances his property portfolio. A deposit bond is a guarantee by a company like Deposit Assure that if Terry defaults at settlement, the vendor will be paid a sum of $100,000 by the deposit bond issuer. Terry hands the deposit bond to the vendor with the signed contract to secure the property.

With so much of household wealth tied up in property, this is a convenient alternative to buyers having to liquidate property or other non-cash assets to pay a contractual deposit which is due sometimes months before settlement.

“The added benefit is that these products are probably a lot safer than cash deposit from a cyber-safety perspective”.

That is, professional cyber hacker sand scammers have recently been impersonating estate agents / conveyancers via email and giving fake payment instructions for payment of deposits. Millions have been lost in the last few years this way.

Deposit bonds avoid this risk by not requiring for large sums of cash to be transferred prior to settlement.

There a handful of deposit bond providers in the market but the provider that we have had the best experiences in dealing with are Deposit Assure.

If you’re interested in the possibility of using a deposit bond on your next transaction, please speak to your conveyancer who will be able to arrange one for you.

Our Blog

As a property-related service provider—whether you’re a mortgage broker, conveyancer, real estate agent or solicitor—it’s important to continuously improve the services you provide. Having a toolkit that solves your clients’ major pain points ensures that you’re able to keep offering excellent service, boost customer loyalty, repeat business and referrals. The fierce property market has only… Read more »

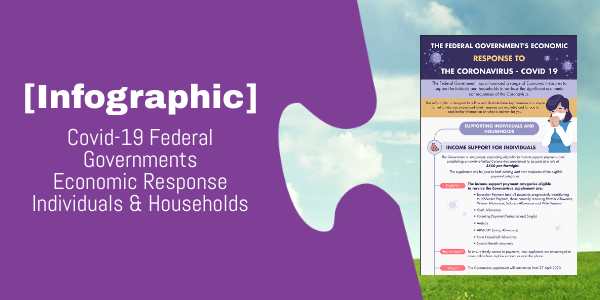

As we’ve seen recently, when developers and builders go into liquidation, the danger for your customers is that their cash deposit could potentially be tied up for years as the liquidation plays out. Even worse, their cash deposit could disappear – check out this recent news article here So in the current market when you are acting… Read more »

Ever wondered where deposit bonds came from? Deposit bonds, also known as deposit guarantees, have been helping Australians buy houses for almost two decades. So how did it all begin?

What supporting documents do you need to get a deposit bond? Why do you need them? And how do you supply them? Find out everything you need to know about supporting documents in this guide.

Lodge & Manage Deposit Bonds for your clients

Lodge & Manage Deposit Bonds for your clients