Deposit Bonds 101: Everything You Need To Know About Supporting Documents

What supporting documents do you need to get a deposit bond? Why do you need them? And how do you supply them? Find out everything you need to know about supporting documents in this guide.

Contracts, Section 32s, financial statements, application forms; when you’re buying a property, you’ll quickly find yourself buried in paperwork. So, the last thing you want to worry about is what documents you need to dig out for a deposit bond.

Here’s the good news: if you have been looking at securing finance through a broker or bank, the documents you need are similar to what they have already asked for.

Read on for everything you need to know about supporting documents, plus handy checklists.

WHY DO I NEED TO SUPPLY SUPPORTING DOCUMENTS?

Here are 4 reasons we need supporting documents for a deposit bond:

#1 Fact checking: We need to verify what you told us during your concierge interview is correct.

#2. Checks and policies: Your documents help us make sure you pass our checks and policies for issuing a deposit bond.

#3. Protect against fraud: Just like banks and lenders, we need to know you’re you. That’s why we ask for photo ID.

#4. Make sure you can secure the funds at settlement: The last thing we want is to issue a bond only for you to struggle to come up with the funds at settlement. It’s not good for you, vendor or anyone! Your supporting documents allow us to make sure you have every chance of securing finance or funds at settlement of your property. That’s why we might ask for proof of income, debts and liabilities.

WHAT DOCUMENTS DO I NEED TO SUPPLY?

Whilst every situation is different, there are some general rules around supporting documents. Here are the supporting documents normally required for two common scenarios:

#1 You’re settling within 6 months WITH proof of funds to complete

In this scenario, your proof of funds could be conditional approval (subject to valuation only), formal unconditional approval from a bank or lender, or proof of funds from the unconditional sale of your current property.

Therefore, we need to verify that you will unconditionally get the funds in time for settlement.

You need to provide:

- Contract of sale for the purchase;

- Photo ID for all applicants (e.g. passport or driver licence);

- Finance approval letter (subject to valuation or unconditional);

- If selling a property, unconditional sale contract/

Is this your situation? Download your own checklist here.

#2 You’re buying property or land WITHOUT proof of funds right now e.g. buying off-the-plan or at auction.

You do not yet have unconditional proof that you will have access to the funds to complete the sale at settlement. Therefore, we will need to conduct our own assessment of your income, home equity and liabilities.

We do this to verify that you will be able to secure finance at settlement, whether that’s 12, 24, 36 or 60 months from now.

You need to provide:

- Contract of sale, including any special conditions, especially any relating to deposit bonds and the sunset clause date or registration date;

- Photo ID for all applicants;

- Proof of your income (last 2 payslips or last 2 years’ tax returns if self-employed);

- Liability statements – mortgage, credit card, personal loan, credit card, car loan etc. Statements must be issued within the last 3 months.

Is this your situation? Download your own checklist here.

HOW DO I SUPPLY THE DOCUMENTS?

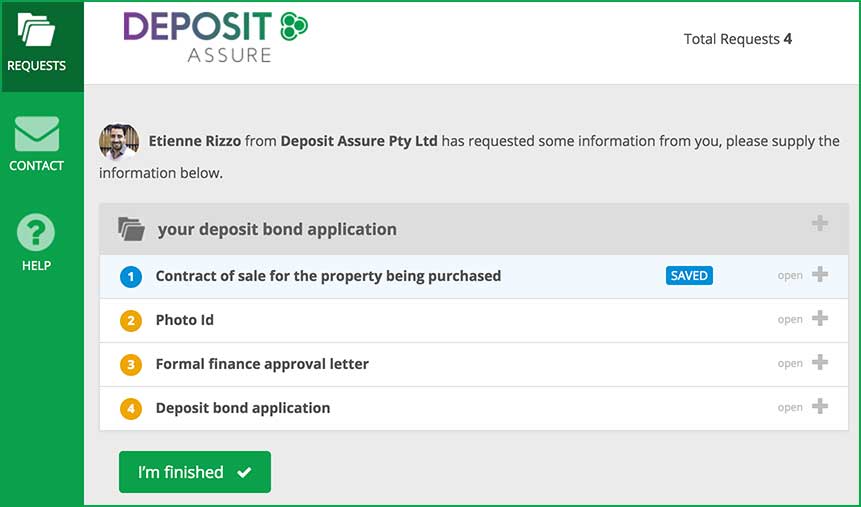

Supplying your documents has never been faster and easier than with Deposit Assure. We’ve launched a new system letting you can upload your documents directly to us.

How it works

#1 Get the link. Once you have spoken to our concierge team, they will assess your situation. If you are eligible for a bond, they will send you a link to your very own portal where you can view all the required supporting documents.

See image below of the client portal.

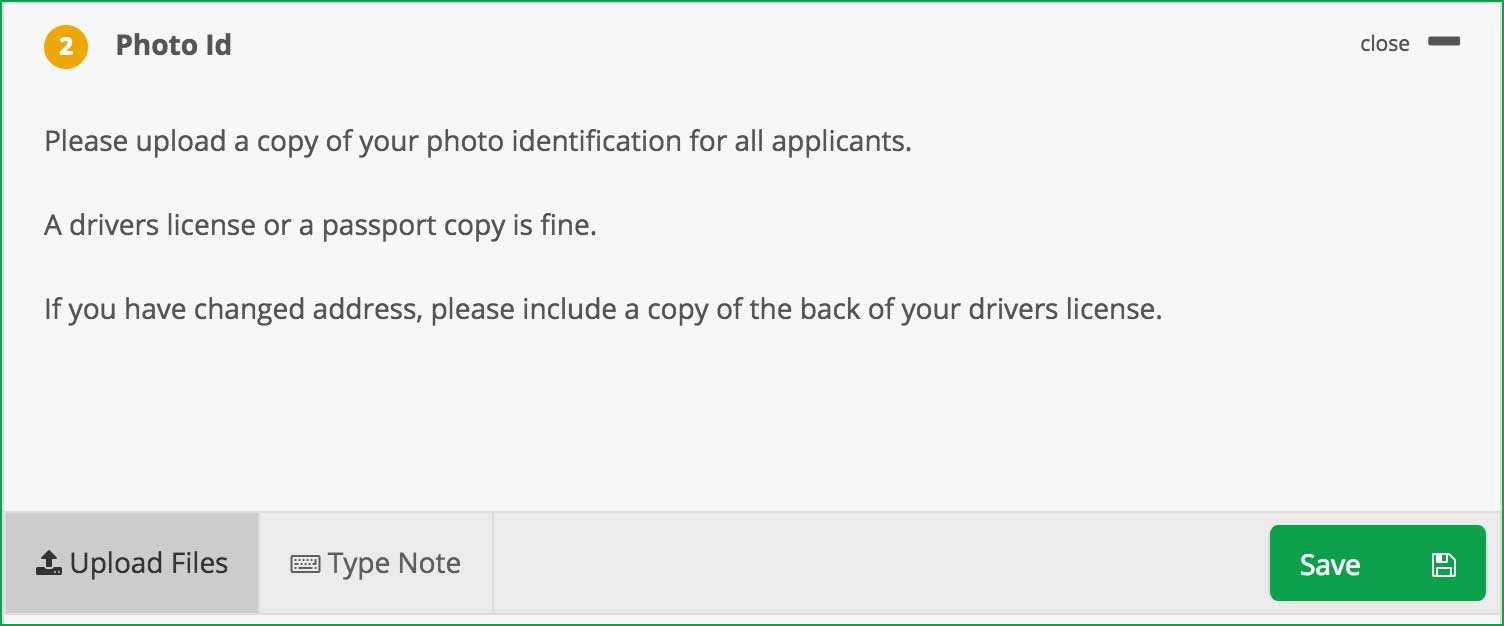

#2 Upload. Gather and upload all the relevant documents we have requested. See image below of the upload file option in the client portal.

#3. Download pre-filled application. Your deposit bond application has been pre-filled for you by our concierge team, using information from your concierge interview. That’s right – you don’t need to complete it yourself! Simply download the application from the portal, check, sign and upload.

#4. Finish. Once all documents have been uploaded, click “I’m finished”.

Then it’s over to us. We will review your documents and submit your application for formal approval. If any documents do not pass our verification, we will simply reject your document through the portal and you will be notified to upload a new one. Easy!

WE ARE HERE TO HELP!

Our concierge team will help you at every stage of your deposit bond application, from go to whoa. No messy forms or paper work to fill out – our team will do it for you. It’s never been simpler to apply for a deposit bond. And the best part is our concierge service is completely free!

Interested in getting a deposit bond? Get started today. Download the relevant supporting documents checklist:

Buying and Selling checklist

Buying and Established Home checklist

Buying at Auction checklist

Buying Off-The-Plan checklist

Buying an Investment Property checklist

First Home Buyer checklist

Buying without Finance Approval checklist

If you have any questions about supporting documents, or anything else deposit bond related, get in touch.

Our Blog

As a property-related service provider—whether you’re a mortgage broker, conveyancer, real estate agent or solicitor—it’s important to continuously improve the services you provide. Having a toolkit that solves your clients’ major pain points ensures that you’re able to keep offering excellent service, boost customer loyalty, repeat business and referrals. The fierce property market has only… Read more »

Guest Post: by Jared Zak from Dott & Crossitt Deposit bonds are being used increasingly in New South Wales and Queensland conveyancing transactions as an alternative to cash deposits. A deposit bond is essentially a promise given by a highly-rated financial institution to pay a vendor a sum equal to ten percent (or occasionally five percent)… Read more »

As we’ve seen recently, when developers and builders go into liquidation, the danger for your customers is that their cash deposit could potentially be tied up for years as the liquidation plays out. Even worse, their cash deposit could disappear – check out this recent news article here So in the current market when you are acting… Read more »

This infographic is designed to collate and illustrate the key measures the Federal Government has taken in response to The Coronavirus – COVID 19.

Ever wondered where deposit bonds came from? Deposit bonds, also known as deposit guarantees, have been helping Australians buy houses for almost two decades. So how did it all begin?

Lodge & Manage Deposit Bonds for your clients

Lodge & Manage Deposit Bonds for your clients