WHAT IS A DEPOSIT BOND?

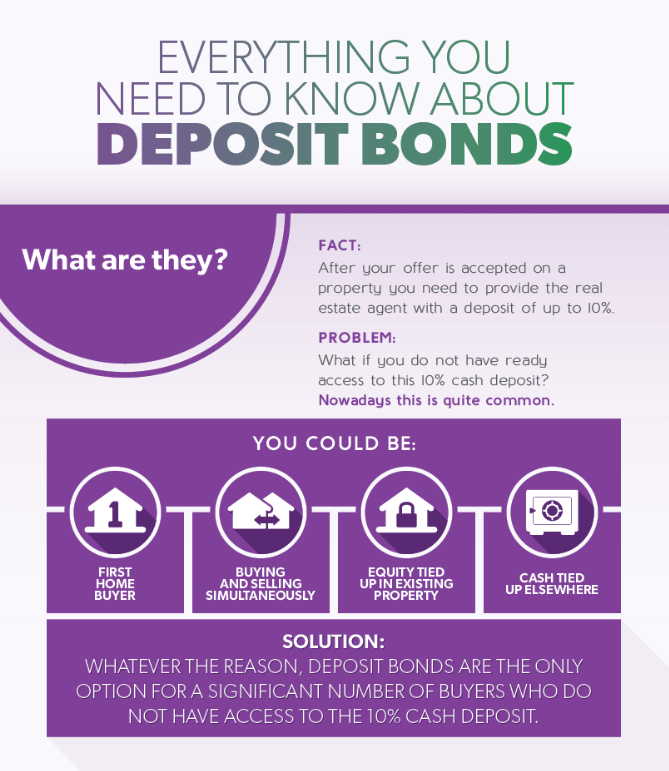

- Borrowing 100% of the purchase price with the loan funds only available at settlement;

- Purchasers who do not have the cash deposit when entering into a contract of sale;

- Purchasers or investors who have their assets tied up in property and are cash poor;

- Buying and selling simultaneously;

- Your cash is working harder for you elsewhere, like your offset account and it can make financial sense to use a deposit bond instead.

- You will get a Pre-Approval within 15 minutes;

- Your application will be sent to you within 1 business hour for eSigning with Docusign;

- Once your application is signed & payment is made, we will dispatch your deposit bond within 1 business hour. Sounds easy? It is!

- Settling under 6 months, the one-off deposit bond fee is 1.3% of the deposit amount required.

When the application is sent to you, by default you will be sent a secure link by email to make payment by credit card and also to sign the application with Docusign.

Should you wish you can also pay via direct EFT or request to sign and scan the application manually.

You can request a refund within 30 days of the Deposit Bond’s issue date. We will process your refund less a $200 administration fee, Alternatively, we can apply your credit to a subsequent purchase. Please send all requests to bonds@depositassure.com.au.

We do not transfer any funds to the vendor, we are only providing a guarantee for the deposit amount which you will pay at the time of Settlement.

When Settlement takes place the deposit bond expires and is no longer valid.

The vendors legal representative who would be holding your deposit bond can choose to dispose of the deposit bond or file it away.

If you have obtained a long term deposit bond, and there is still greater than 6 months remaining on your bond, you can send the original deposit bond to Deposit Assure to see if you are eligible for a pro rata refund. For Digital Bonds issued after December 2020 please email bonds@depositassure.com.au *conditions apply