Auction Bond vs Deposit Bond – Which one is right for you?

For many homebuyers, deposit bonds are the missing piece required to secure their new property, so it pays to know the difference between different types of deposit bonds if you are going to unlock their potential.

In this article, I’ll explain the difference between an auction bond and a deposit bond.

Both types allow the buyer to provide a guarantee for up to 10% of the purchase price to secure their new property or land purchase.

But there are a few differences between auction bonds and deposit bonds that matter. Choose the right one now and you could save time and hassle down the track – not to mention get ahead of the competition.

Let’s break it down.

First, know the basics.

There are similarities between both types of deposit bonds. Among them:

Both types provide a guarantee for up to 10% of the purchase price to secure a new property or land purchase.

With both, the purchaser only pays the deposit bond fee up-front – then at settlement, they pay the full purchase price plus the deposit and any costs (stamp duty etc.)

Both types are ideal if you don’t have access to the 10% cash deposit, e.g. buying and selling at the same time, downsizing, first-home buyers, investors and more.

But there are also important differences.

A deposit bond is ideal if your offer has been accepted. If you have already made an offer and know the 10% deposit amount required – this is when a deposit bond can be used.

An auction bond is like a blank cheque. It gives you the flexibility to be prepared to hand over a 10% on the day of auction – whatever that might be. You might not be successful with your first auction – but that’s okay because an auction bond can be valid for 3 or 6 months (depending on which is best). This means you can keep taking it to auctions until you place the winning bid! A deposit bond, on the other hand, needs to be valid up until the settlement date or sunset clause date if buying off the plan.

Auction or deposit bond: which should you choose?

To work out whether you need an auction bond or a deposit bond, ask yourself the following questions:

Are you planning to purchase in an auction market?

If you are planning on purchasing in an auction market, keep in mind that the winning bidder is typically required to pay up to a 10% cash deposit to secure the property. If you do not have ready access to a cash deposit, you can use an auction deposit bond to secure the property.

There are 4 big advantages to choosing an auction bond:

#1. If your equity is locked up in your current home, an auction bond can help you secure the purchase property without the hassle of redrawing on your mortgage or taking out another loan. There’s no interest on an auction bond.

#2. In most cases you may be selling your home, or intend to sell at a later date. So an auction bond makes sure you are ready to land that killer bid.

#3. You can re-use the auction bond until you are successful. No need to apply again and again before each auction.

#4. Once your bid is accepted, you can fill out the final purchase price and the vendor’s details, before handing over the final auction bond to secure your new purchase – all on the same day!

Have you made an offer on a property and is it accepted?

If you have made an offer on a property and it’s been accepted, there is no need to get an auction bond. Why? Because an auction bond is typically used when you have not yet had an offer accepted and you are unsure which property you will end up buying. So if your offer has already been accepted, a deposit bond can be issued based on the contract of sale and final price the purchaser has agreed with the real estate agent.

Sometimes a deposit bond is cheaper.

Depending on your situation, it may be cheaper for you to get a deposit bond. That’s because the bond is issued directly on a “known” property and you may already have formal finance approval, which may mean you can get the deposit bond for a slightly cheaper fee. But whichever you choose, remember there is no interest – just the one-off fee to the deposit bond provider. To compare costs, use Deposit Assure’s easy online fee calculator.

RECAP

When to choose an auction bond:

#1. You are bidding at auction’;

#2. You are unsure which property you will end up buying’;

#3. You do not have cash readily available for the 10% required.

When to choose a deposit bond:

#1. You are not buying at auction but still need access to a deposit up to 10%;

#2. Your purchase offer has already been accepted – you simply need a deposit bond to complete the sale;

#3. You are buying in a private treaty or off-the-plan.

BONUS TIPS

When using an auction bond, you can still secure the property pre or post auction – Once your offer is accepted. Simply fill out the details and hand in the auction bond.

Always consult the auctioneer or real estate agent to make sure they will accept a QBE-backed deposit bond on the day of auction.

The fee for a Deposit Assure auction bond is the same whether you choose 3 or 6 months, so choose a 6-month bond for added value!

If you are not successful, and you return the unused auction bond within 30 days of issue, you can get a full refund less $200 admin and processing fee. So there’s nothing to lose!

Want some help to choose between an auction bond or a deposit bond?

Click the button below and one of our concierge team will call you right back.

Our Blog

As a property-related service provider—whether you’re a mortgage broker, conveyancer, real estate agent or solicitor—it’s important to continuously improve the services you provide. Having a toolkit that solves your clients’ major pain points ensures that you’re able to keep offering excellent service, boost customer loyalty, repeat business and referrals. The fierce property market has only… Read more »

Guest Post: by Jared Zak from Dott & Crossitt Deposit bonds are being used increasingly in New South Wales and Queensland conveyancing transactions as an alternative to cash deposits. A deposit bond is essentially a promise given by a highly-rated financial institution to pay a vendor a sum equal to ten percent (or occasionally five percent)… Read more »

As we’ve seen recently, when developers and builders go into liquidation, the danger for your customers is that their cash deposit could potentially be tied up for years as the liquidation plays out. Even worse, their cash deposit could disappear – check out this recent news article here So in the current market when you are acting… Read more »

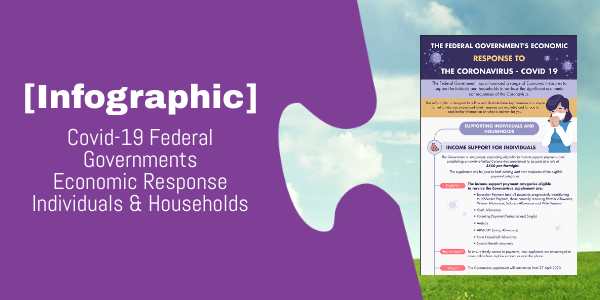

This infographic is designed to collate and illustrate the key measures the Federal Government has taken in response to The Coronavirus – COVID 19.

Ever wondered where deposit bonds came from? Deposit bonds, also known as deposit guarantees, have been helping Australians buy houses for almost two decades. So how did it all begin?

Lodge & Manage Deposit Bonds for your clients

Lodge & Manage Deposit Bonds for your clients