5 Killer Tips For Email Marketing (+ Free Templates To Send Today)

Gone are the days of sighing “spam, spam, spam” as we filter through our daily emails. Now we simply hit delete as soon as we spy an email that doesn’t immediately compel us to open and read.

But as a mortgage broker or real estate agent, the last thing you want a client or prospect to do is hit “delete” on your emails. That’s why we’re sharing our best practices to ensure you get your content right.

Today email is the most popular channel for marketing. The crux is businesses are sending more emails than ever and, as a result, messages are easy to skip over, ignore or simply delete.

Get it right, though, and you can engage your target audience and build a trusting relationship. To do this, you must use industry knowledge and resources to give your subscribers something they wouldn’t otherwise have access to – and present it in a way that they cannot ignore.

Before we get to the templates, here are 5 killer tips for email marketing:

1. EDUCATE, DON’T SELL

Knowledge is a powerful thing and when it comes to buying a property, you have the knowledge that your clients need. Take the time to find the right content for your audience and build their trust. Sending content that helps clients learn more about the world of mortgages and real estate shows that you care about their needs. Not to mention it also proves that you are an expert in your industry.

2. TEST, TEST, TEST

Take the time to test your emails. Pay particular attention to the subject line, which is the single most powerful part of your email. After all, it alone determines whether or not the recipient opens the email in the first place. Test and tweak your subject line to make the right impact. Try a few variations and evaluate their performance using small test sends.

3. THINK MOBILE

More than 50% of Australian consumers now open emails on a mobile device first. So ensure your emails are designed to be concise and easy to read on a small screen. Even the most basic responsive design techniques will result in higher click-through rates.

4. GET TO THE POINT

Your prospects only spend 20 to 30 seconds reading an email, so it’s critical that you get to the point, and fast. It doesn’t matter how well-written and targeted your email is, if you ramble on and on, you run the risk of being ignored.

5. STRONG CALL TO ACTION

Whether you want people to call for advice or click through to your website to make an appointment, you need to make your call to action strong and clear. Don’t leave it to the end, either – add clear call-to-actions or links throughout your email content.

How well do you know your email subscribers?

Think about their challenges and needs when planning your next email campaign. They could be holding back on making their next purchase for the simple reason that they don’t have the 10% deposit to secure their purchase. That’s why we’ve put these expert tips (and more) into action with two killer email templates to help you drive more conversions with deposit bonds.

If you would like to find out more about how to make the most of your marketing for deposit bonds,

please get in touch with us.

Our Blog

As a property-related service provider—whether you’re a mortgage broker, conveyancer, real estate agent or solicitor—it’s important to continuously improve the services you provide. Having a toolkit that solves your clients’ major pain points ensures that you’re able to keep offering excellent service, boost customer loyalty, repeat business and referrals. The fierce property market has only… Read more »

Guest Post: by Jared Zak from Dott & Crossitt Deposit bonds are being used increasingly in New South Wales and Queensland conveyancing transactions as an alternative to cash deposits. A deposit bond is essentially a promise given by a highly-rated financial institution to pay a vendor a sum equal to ten percent (or occasionally five percent)… Read more »

As we’ve seen recently, when developers and builders go into liquidation, the danger for your customers is that their cash deposit could potentially be tied up for years as the liquidation plays out. Even worse, their cash deposit could disappear – check out this recent news article here So in the current market when you are acting… Read more »

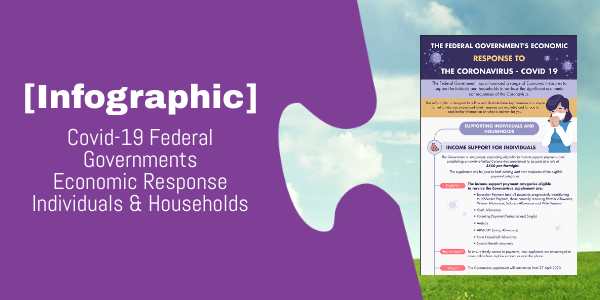

This infographic is designed to collate and illustrate the key measures the Federal Government has taken in response to The Coronavirus – COVID 19.

Ever wondered where deposit bonds came from? Deposit bonds, also known as deposit guarantees, have been helping Australians buy houses for almost two decades. So how did it all begin?

Lodge & Manage Deposit Bonds for your clients

Lodge & Manage Deposit Bonds for your clients